-40%

US STEEL Wood Foundry Industrial MACHINE Pattern Mold Architectural Salvage Vtg

$ 99.79

- Description

- Size Guide

Description

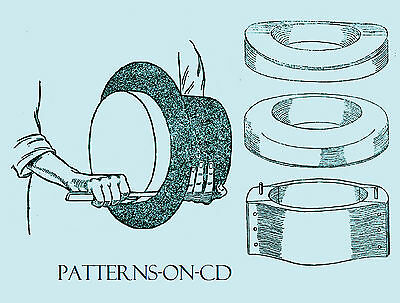

Antique US STEEL Wood Foundry Industrial Pattern Mold Architectural Salvage Vtg.This unusual bowl shaped pattern likely took days to complete.

Dimensions are shown in photographs. Weight is approximately 50 pounds

It represents the engenuity and industry of America at its peak of prosperity. Employers like United States steel evolved the American middle class.

This pattern was carved in the Johnstown United States steel plant in early 20th century. The patterns carved here were used throughout America and the World.

When employed as utilitarian sculpture and/ or architecture these pieces add history and a story to your décor

As an assemblage sculptor, I would normally finish this piece as wall art or a coffee table with metal casters and a glass top........... The juried art shows that I normally participate in have been canceled due to virus............. My studio, IronWood ARTifacts LLC , Is open and I would be happy to custom make something for you from any of the pieces in my collection.

PICK UP IN JOHNSTOWN IS FREE

I have included photos Of patterns that will be listed In the future. Large pieces and or quantities can be delivered via our truck. PLEASE INQUIRE

The United States Steel Corporation is the largest integrated steel company in the United States and the 11th largest in the world. It produces and sells a wide range of semi-finished and finished steel products, coke, and taconite pellets. It operates smaller businesses in real estate, engineering, mining, and financial services. The company owns and operates a steel production facility in the Slovak Republic that supplies the Eastern European market. It also engages in joint ventures with Japanese and Korean steelmakers.

Origins: 1873-1915

The origin of United States Steel Corporation (U.S. Steel) is virtually an early history of the steel industry in the United States, which in turn is closely linked to the name of Andrew Carnegie. The quintessential 19th-century self-made man, Carnegie began as a bobbin boy in a cotton mill, made a stake in the railroad business, and, in 1864, started to invest in the iron industry. In 1873 he began to establish steel plants using the Bessemer steelmaking process. A ruthless competitor, he led his Carnegie Steel Company to be the largest domestic steelmaker by the end of the century. In 1897 Carnegie appointed Charles M. Schwab, a brilliant, diplomatic veteran of the steel industry who had worked his way up through the Carnegie organization, as president of Carnegie Steel.

At about the same time, prominent financier John Pierpont Morgan became a major participant in the steel industry as a result of his organization of the Federal Steel Company in 1898. Morgan's personal representative in the steel business was Elbert Henry Gary, a lawyer, former judge, and director of Illinois Steel Company, one of the several steel companies co-opted into Federal Steel, of which Gary was made president. Carnegie, Schwab, Morgan, and Gary were the key participants in the organization of U.S. Steel.

By 1900 the demand for steel was at peak levels, and Morgan's ambition was to dominate this market by creating a centralized combine, or trust. He was encouraged in this by rumors of Carnegie's intention to retire from business. U.S. President William McKinley was known to approve of business consolidations, and his support limited the risk of government antitrust claims in the face of a steel industry combination. In December 1900 Morgan attended a now-legendary dinner at New York's University Club. During the course of the evening Schwab gave a speech that set forth the outlines of a steel trust, the nucleus of which would be the Carnegie and Morgan steel enterprises, together with a number of other smaller steel, mining, and shipping concerns. With Schwab and Gary as intermediaries between Carnegie and Morgan, negotiations were concluded by early February 1901 for Carnegie to sell his steel interests for about 2 million in bonds and stock of the new company. The organization plan was largely executed by Gary, with Morgan arranging the financing. On February 25, 1901, United States Steel Corporation was incorporated with an authorized capitalization of .4 billion, the first billion-dollar corporation in history. The ten companies that were merged to form U.S. Steel were American Bridge Company, American Sheet Steel Company, American Steel Hoop Company, American Steel & Wire Company, American Tin Plate Company, Carnegie Steel Company, Federal Steel Company, Lake Superior Consolidated Iron Mines, National Steel Company, and National Tube Company.

At Morgan's urging Schwab became president of U.S. Steel, with Gary as chairman of the board of directors and of the executive committee. Two such strong personalities, however, could not easily share power. In 1903 Schwab resigned and soon took control of Bethlehem Steel Corporation, which he eventually built into the second-largest steel producer in the country. Gary stayed on as, in effect, chief executive officer to lead U.S. Steel and to dominate its policies until his death in August of 1927. His stated goal for U.S. Steel was not to create a monopoly but to sustain trade and foster competition by competing on a basis of efficiency and price. Steel prices did drop significantly in the years after the company began, and, because of competition, U.S. Steel's market share of U.S. steel production dropped steadily over the years from about 66 percent in 1901 to about 33 percent from the 1930s to the 1950s. U.S. Steel's sales increased from 3 million in 1902 to billion during the 1920s, dropped to a low of 8 million in 1933, reached billion in 1940, and climbed to about billion in 1950. Except for a few deficit years, U.S. Steel's operations have been generally profitable, though earnings have been cyclical.